Designers

Yelyzaveta Kolesnyk, James Green, Arjun Kumar, Eamon Shahir

Year

2024

Category

Product

Country

United Kingdom

Design Studio / Department

@Taxd - Design Department

Three questions for the project team

What was the particular challenge of the project from a UX point of view?

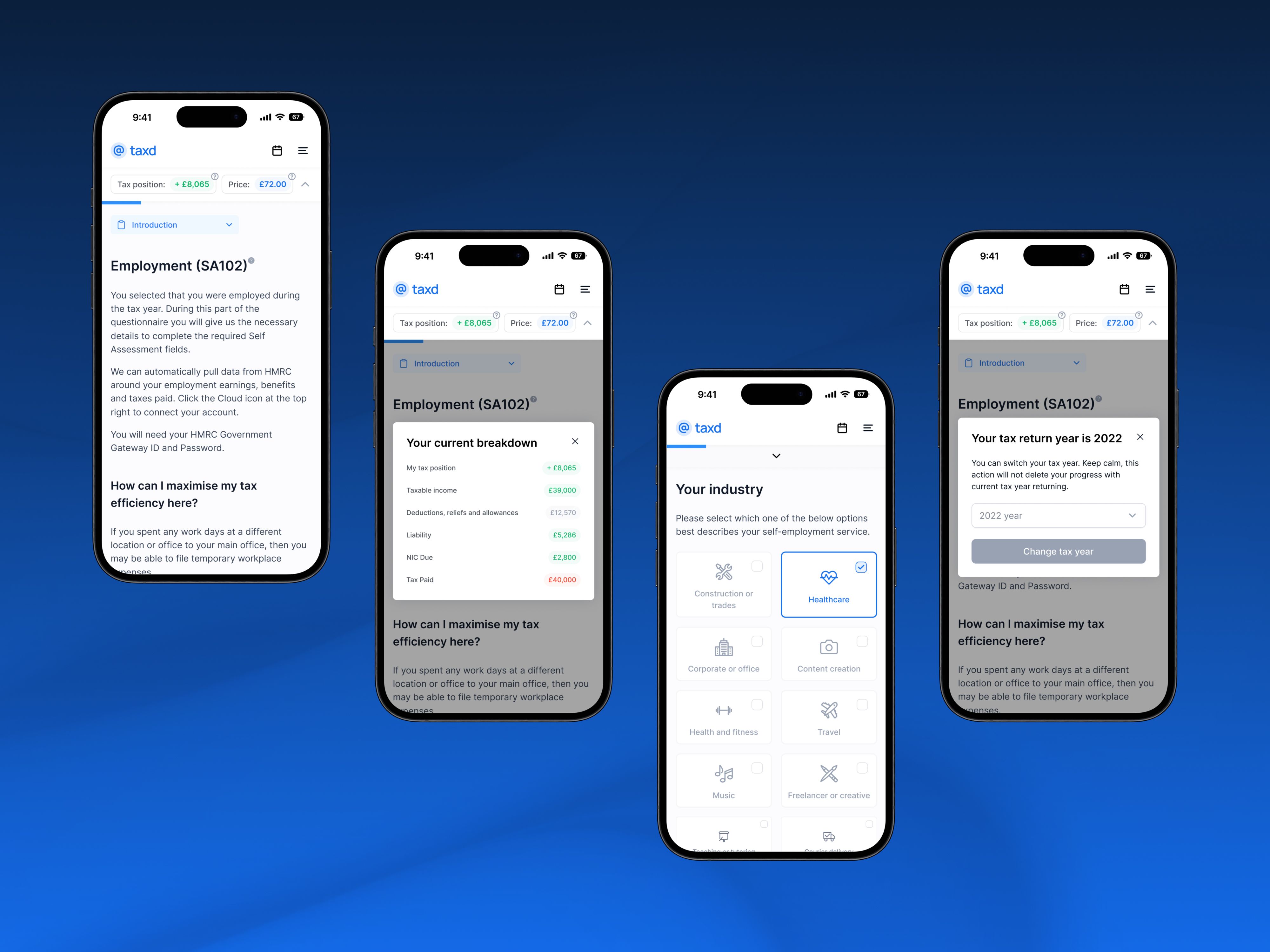

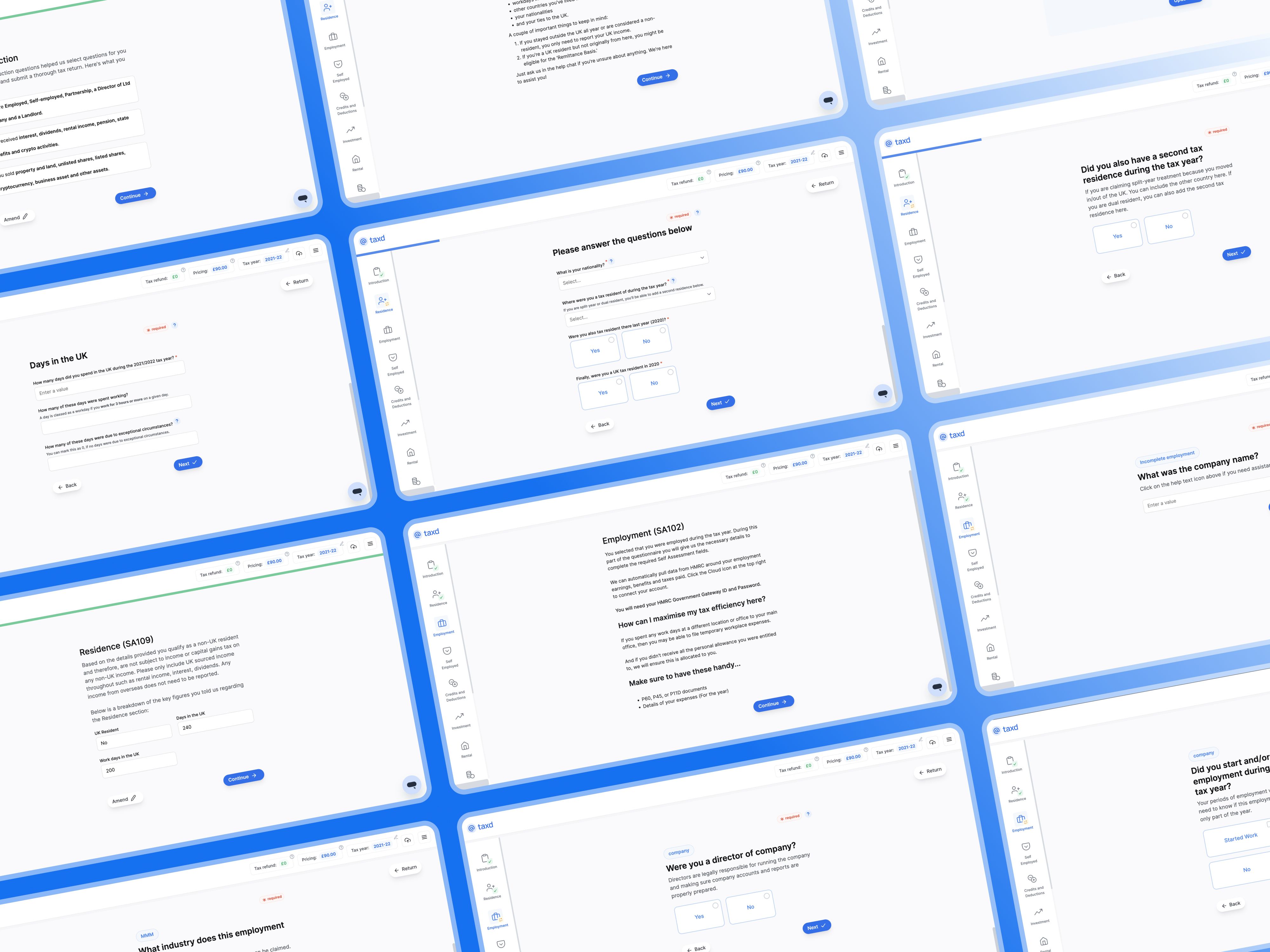

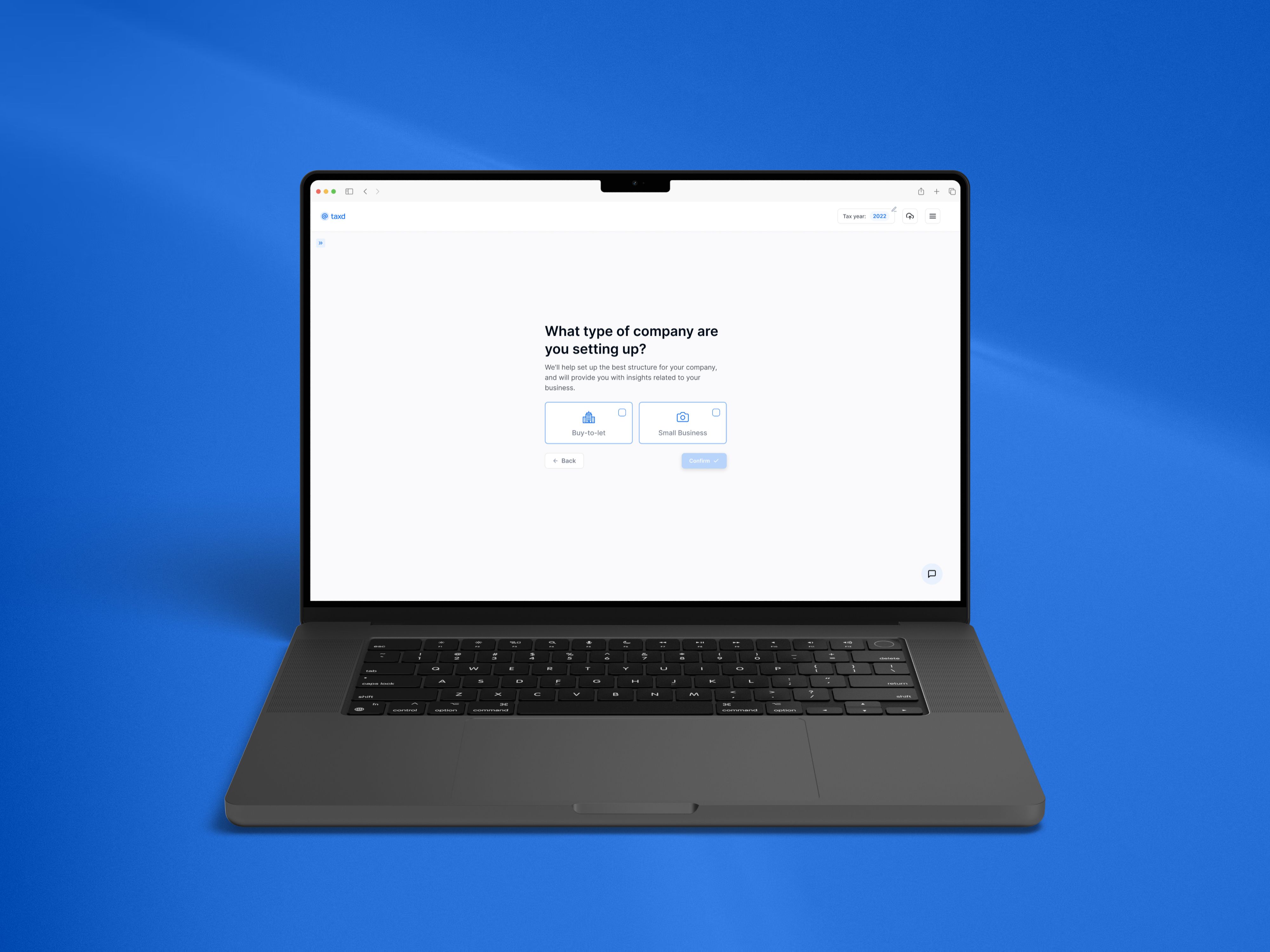

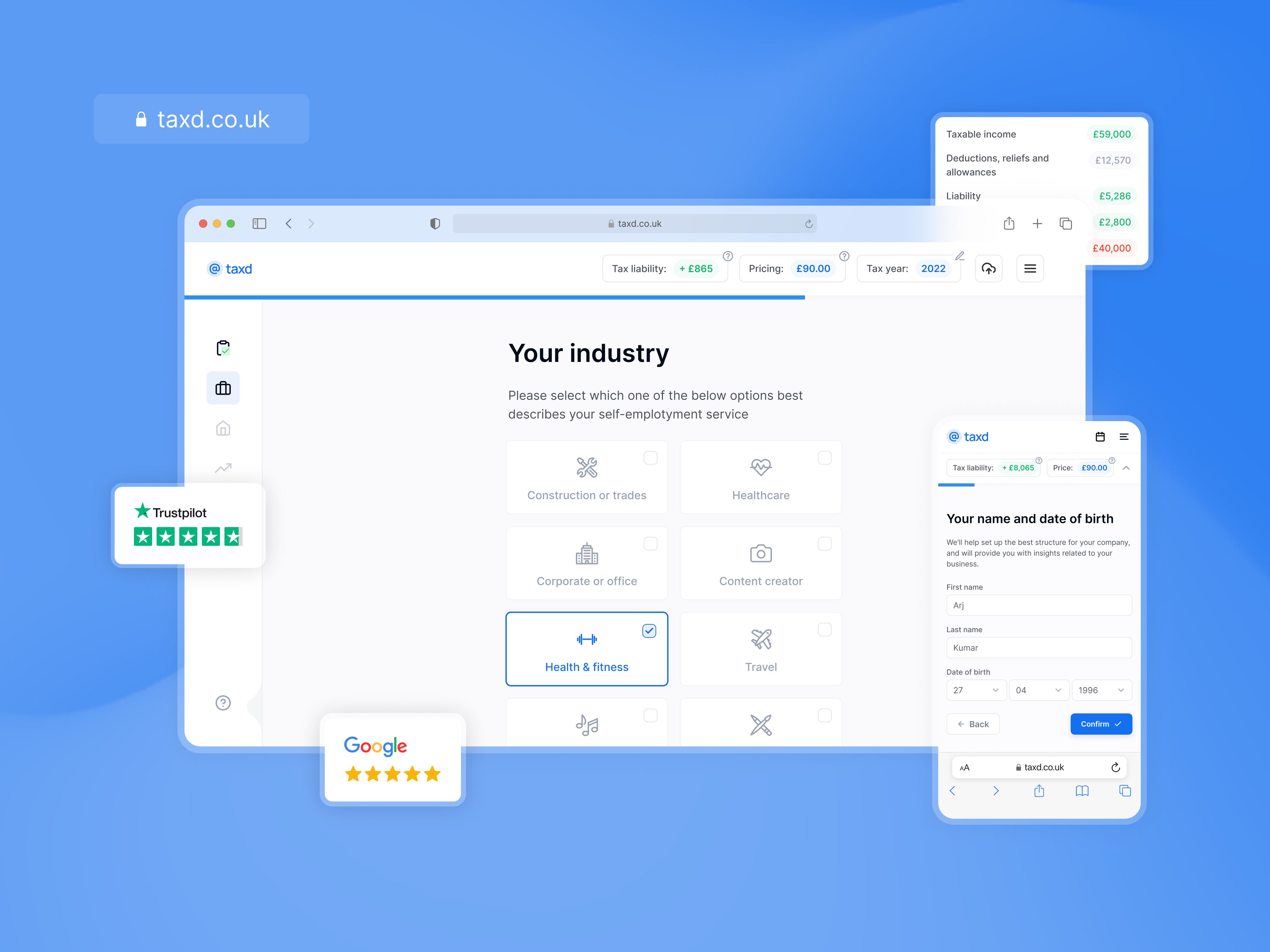

The UX challenges involved reassuring users wary of making mistakes in their tax returns, ensuring simplicity while maximising relevant information collection. The key was to gather enough data to personalise questions without overwhelming the user, identifying opportunities for extra tax relief prompts. The system breaks down complex calculations into simple components, easing the process for users. The aim was to craft a user experience so intuitive that getting stuck was unlikely, striking a balance between technological simplicity and tax thoroughness. This approach was essential in building trust in a non-accountant solution, reducing tax-related stress, and maintaining user confidence in the service's simplicity and pricing.

What was your personal highlight in the development process? Was there an aha!-moment, was there a low point?

The development process saw the linking of the UX and dev team everyday during a standup with additional meetings throughout the day to ensure complete synchronisation. The original engine that we developed for the product was inflexible due to time constraints and modifications due to user feedback. This led to difficulties when trying to improve the product as the foundation couldn't support it. This was a definite low point as it meant we had to rethink the way our product was working entirely and rebuild it with the new changes in mind. However with the new engine came new possibilities for improvements throughout such as the split from a lot of questions to few groups of questions and the possibility to hide questions altogether.

Where do you see yourself and the project in the next five years?

We’re driving towards a world where taxes are completely autonomous. The challenge lies in creating a seamless user experience to pull all the relevant data together, and categorise accurately. We will leverage our user experience and client base to build on our tool, and hopefully reduce self-assessment time by 80%, improve return accuracy (by reducing human errors) and completeness (reduce reviews/penalties), reduce tax and maximise deductions for UK taxpayers. We’d also love to expand to international markets that have similar digital approaches to HMRC, leveraging the UX but adjusting for local tax, regulatory and behavioural knowledge. (and we hope to win the 2024 UX Design Award :)