Designers

Kenzo Matsuda, Monica Bastianpillai, Ronny Michael, Crystal Huang

Year

2026

Category

Product

Country

Canada

Design Studio / Department

Digital Experience Design

Three questions to the project team

What was the particular challenge of the project from a UX point of view?

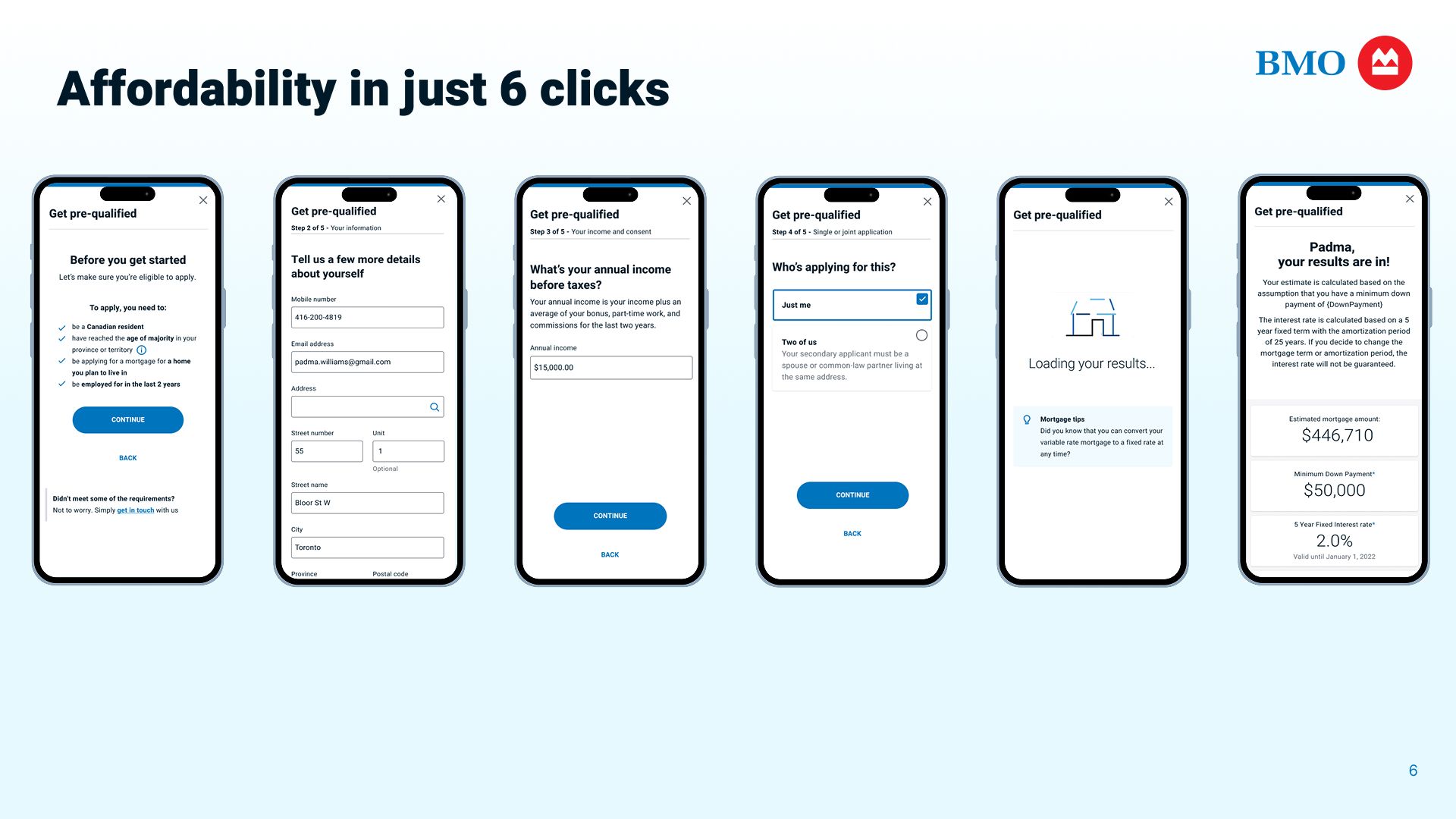

One of our biggest hurdles was dealing with technical limitations. API response times were inconsistent and slow, which frustrated users who wanted quick estimates. To turn this challenge into an opportunity, we introduced dynamic mortgage tips during loading screens—taking inspiration from video games like Call of Duty. Instead of waiting idly, users now learn helpful insights while the system processes their request. This simple change transformed downtime into a value-added experience, keeping users informed and engaged throughout pre-qualification.

What was your personal highlight in the development process? Was there an aha!-moment, was there a low point?

Our “aha” moment came early, after research and competitive analysis revealed a major gap: competitor tools asked users for a home purchase price, but the homebuyers we interviewed didn’t know what they could afford—and expected the tool to guide them. This insight shifted our focus from price to affordability, leading us to redesign the experience around providing users with a personalized affordability estimate.

Where do you see yourself and the project in the next five years?

In five years, pre‑qualification will be a fully automated, AI‑powered experience. Customers will provide minimal information—often just stating their intent and uploading a few documents—and an LLM will instantly extract data, verify income, assess eligibility, and generate a personalized pre‑qualification result in seconds. The experience will feel flexible, modular, and intelligent, supporting multiple applicants and scenarios while positioning BMO as a fast, trusted, low‑effort starting point for homebuyers.