Year

2025

Category

Product

Country

Turkey

Design Studio / Department

Digital Design & Innovation

Three questions to the project team

What was the particular challenge of the project from a UX point of view?

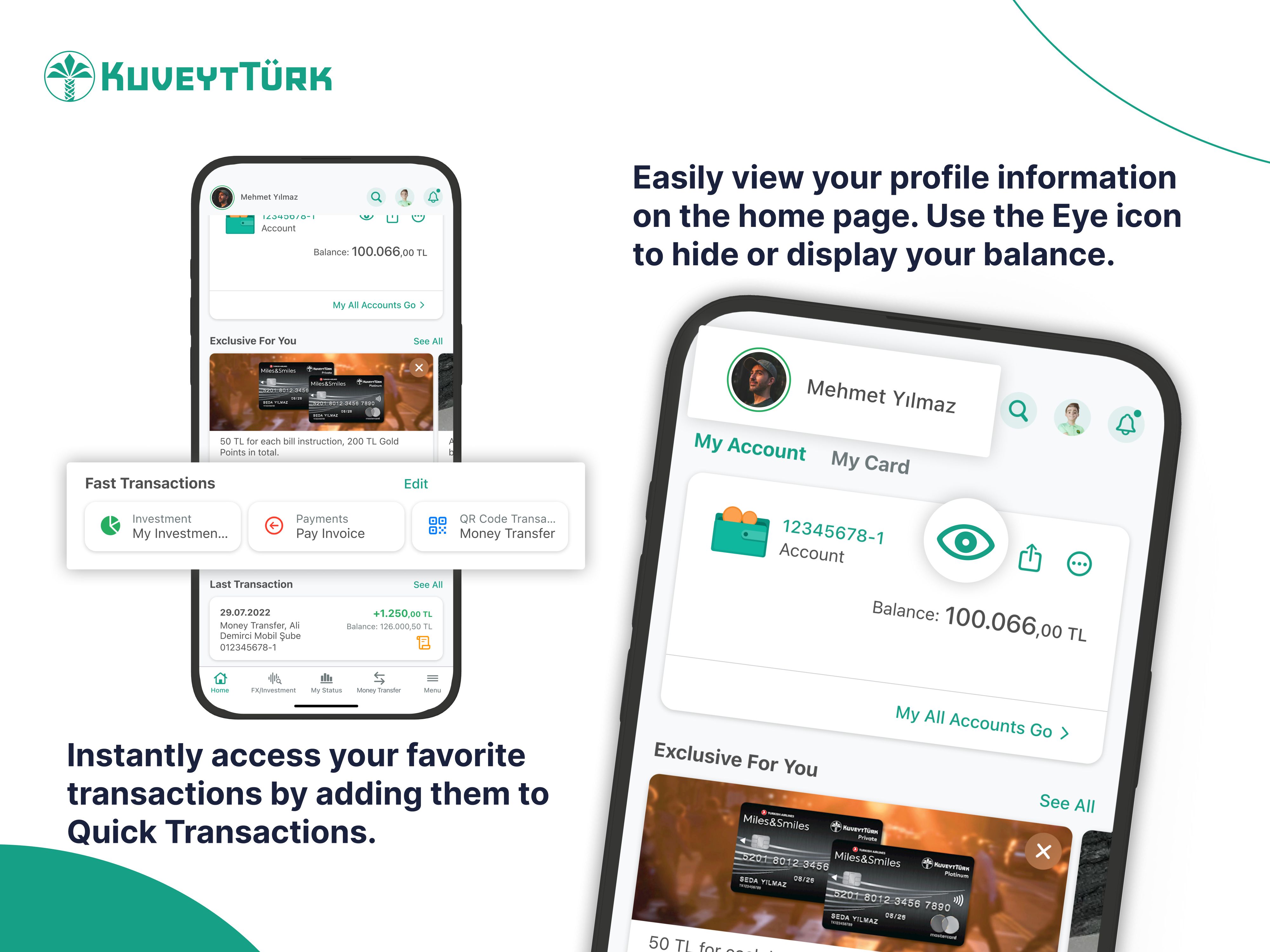

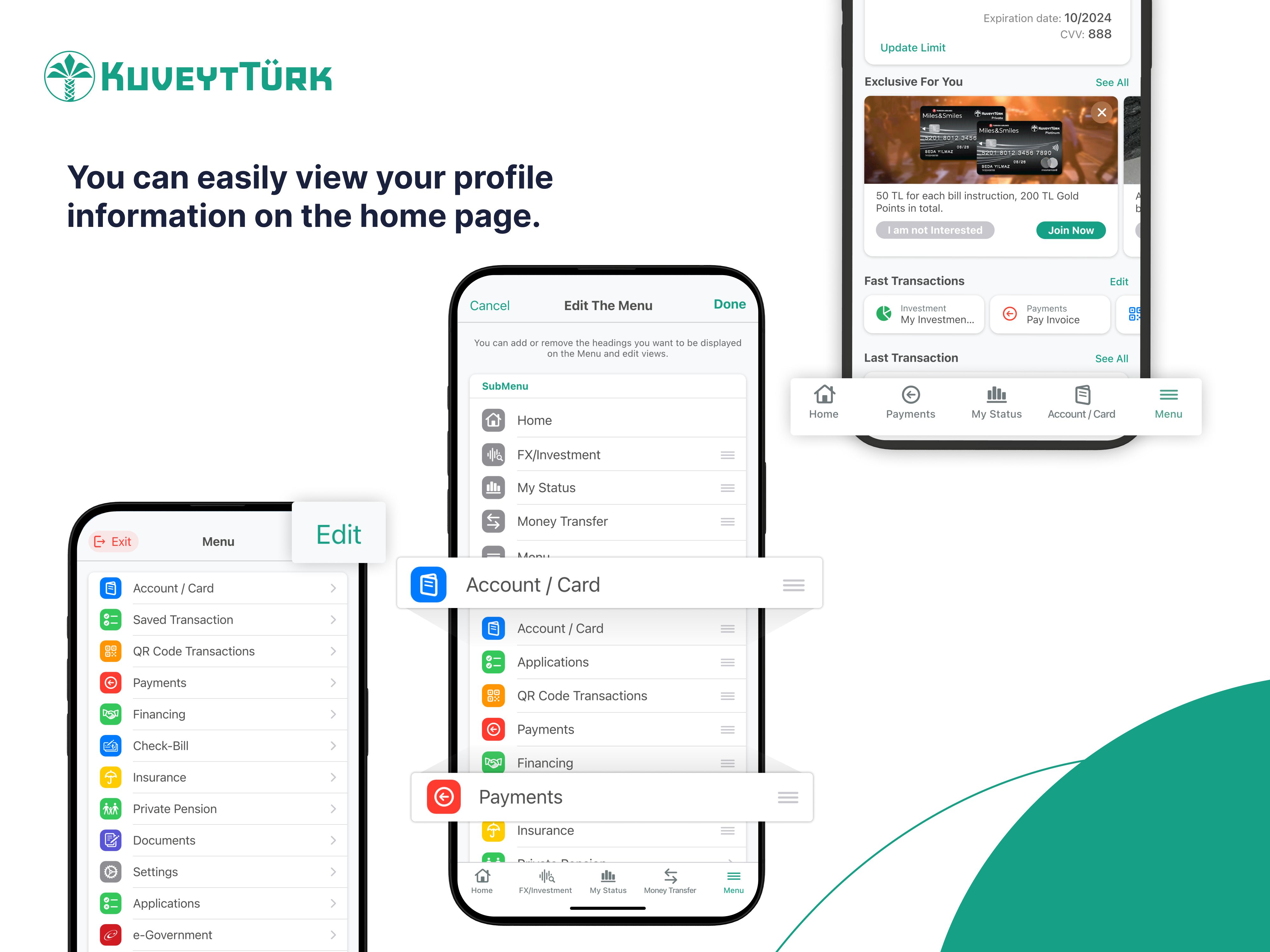

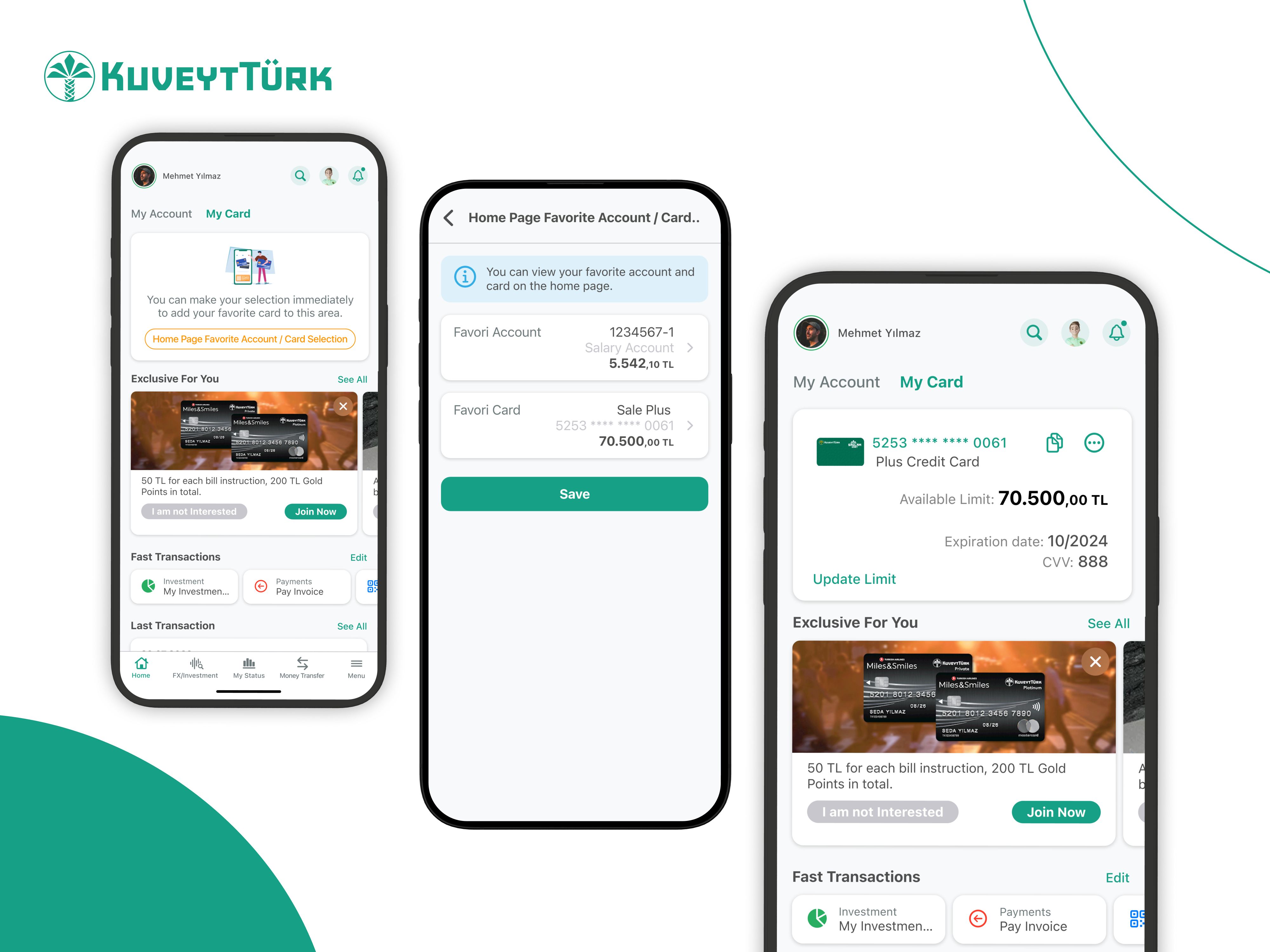

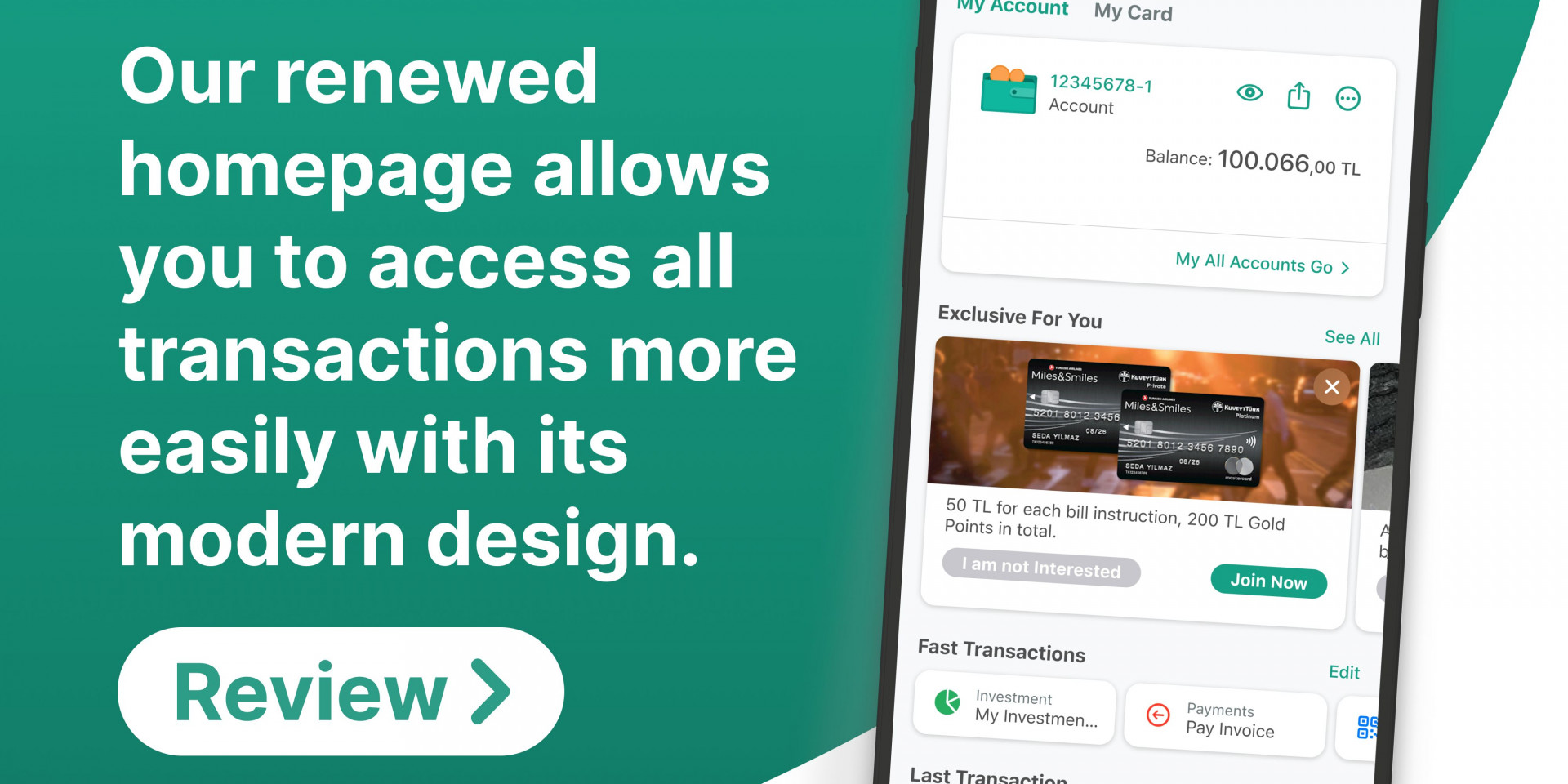

The key UX challenge was to modernize our digital banking interface without alienating existing users who had formed habits around the old layout. We needed to strike a careful balance between innovation and familiarity. Our goal was to create a more compact, personalized, and action-oriented user interface while integrating new features such as Favorites, Quick Actions, . Achieving a seamless transition—particularly personalized the navigation bar, optimizing the home screen, and implementing real-time dynamic components like the Doodle feature—required deep user empathy, iterative testing, and behavioral insights.

What was your personal highlight in the development process? Was there an aha!-moment, was there a low point?

The highlight came during usability testing when we observed users complete complex financial tasks significantly faster through the new Quick Action panel. One participant expressed, “It feels like the app knows what I need before I do.” That was our “aha!” moment—proof that personalization and simplicity can coexist in a banking interface. A low point was during early testing when we realized the relocated menu structure (from top left to bottom navigation) caused confusion among long-time users. This insight prompted a redesign that blended iconography, tooltips, and visual cues to make the transition intuitive. That moment reinforced the importance of not just designing for the user, but with the user.

Where do you see yourself and the project in the next five years?

Over the next five years, we see this project evolving into a proactive Personal Finance Manager. We aim to deliver a dynamic experience that adapts to user behavior, offering actionable insights and personalized budgeting suggestions. This transformation builds on the foundation we’ve created: a cleaner, more compact interface with features like Quick Actions, Favorites, and the chatbot. By layering AI-driven personalization on top of our UX improvements, we plan to turn everyday banking into a more intuitive and empowering experience. this journey is about more than feature delivery—it’s about shaping the future of inclusive digital banking, where users feel understood, supported, and in control of their financial well-being.